Protect Your Framework: Trust Foundations for Long Life

Protect Your Framework: Trust Foundations for Long Life

Blog Article

Securing Your Assets: Count On Structure Knowledge at Your Fingertips

In today's complex economic landscape, guaranteeing the safety and growth of your possessions is extremely important. Trust fund foundations serve as a foundation for securing your wide range and legacy, offering an organized technique to asset defense.

Importance of Count On Structures

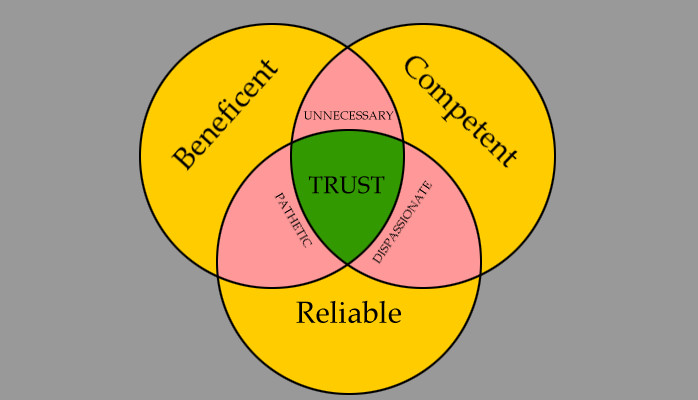

Trust fund foundations play a crucial duty in establishing reliability and cultivating strong connections in numerous specialist settings. Count on foundations serve as the foundation for moral decision-making and clear interaction within companies.

Benefits of Expert Guidance

Building on the structure of depend on in professional connections, looking for expert assistance offers vital advantages for individuals and companies alike. Expert assistance offers a wide range of knowledge and experience that can help navigate complex monetary, lawful, or strategic difficulties easily. By leveraging the knowledge of specialists in various areas, people and companies can make enlightened choices that line up with their objectives and aspirations.

One substantial benefit of expert support is the ability to access specialized knowledge that may not be easily available or else. Specialists can offer insights and point of views that can cause ingenious solutions and opportunities for development. In addition, dealing with experts can assist minimize dangers and uncertainties by supplying a clear roadmap for success.

In addition, professional assistance can save time and sources by enhancing processes and staying clear of pricey errors. trust foundations. Professionals can use tailored advice tailored to details requirements, making certain that every decision is educated and tactical. Overall, the benefits of expert advice are complex, making it a valuable asset in safeguarding and taking full advantage of properties for the long term

Ensuring Financial Protection

Guaranteeing monetary security involves a multifaceted method that encompasses various aspects of riches monitoring. By spreading out investments throughout various property courses, such as supplies, bonds, real estate, and products, the threat of considerable monetary loss can be alleviated.

Additionally, preserving a reserve is important to secure against unexpected expenses or income interruptions. Specialists suggest setting apart three to six months' well worth of living expenditures in a fluid, quickly available account. This fund acts as an economic safety net, providing peace of mind during rough times.

Consistently assessing and adjusting financial plans in action to transforming situations is also extremely important. Life occasions, market fluctuations, and legal adjustments can influence monetary stability, emphasizing the value of continuous assessment and adjustment see this page in the quest of long-lasting economic safety - trust foundations. By applying these approaches attentively and continually, people can fortify their monetary footing and job in the direction of a more secure future

Safeguarding Your Properties Efficiently

With a solid foundation in position for monetary security through diversification and emergency fund upkeep, the next critical step is protecting your properties successfully. Guarding possessions entails protecting your riches from possible risks such as market volatility, economic slumps, lawsuits, and unpredicted costs. One efficient approach is asset allowance, which entails spreading your investments throughout various possession classes to minimize threat. Diversifying your portfolio can help alleviate losses in one location by stabilizing it with gains in one more.

In addition, developing a trust can offer a safe means to secure your assets for future generations. Trust funds can help you regulate just how your assets are distributed, minimize estate tax obligations, and secure your wealth from financial institutions. By carrying out these strategies and seeking specialist advice, you can protect your assets properly and safeguard your economic future.

Long-Term Possession Security

Lasting asset protection involves executing measures to secure your properties from different risks such as economic declines, suits, or unforeseen life events. One important element of lasting asset protection is developing a count on, which can use significant advantages in protecting your properties from creditors and lawful disputes.

Moreover, expanding your investment portfolio is another key method for long-lasting asset security. By spreading your financial investments across various property classes, industries, and geographical areas, you can decrease the effect of market fluctuations on your general riches. Additionally, consistently reviewing and upgrading your estate strategy is important to make certain that your assets are shielded according to your desires in the long run. By taking a positive technique to long-lasting possession security, you can safeguard your wide range and give economic safety and security on your own and future generations.

Final Thought

Finally, depend on foundations play a vital function in safeguarding properties and making certain monetary protection. Professional guidance in establishing and managing trust frameworks is crucial for long-term asset protection. By using the competence of specialists in this area, people can successfully secure their properties and strategy for see it here the future with moved here confidence. Trust foundations give a solid structure for protecting riches and passing it on future generations.

Report this page